24/08/2023 | Buy a property

SALES AND RENTAL PRICE* TRENDS FOR APARTMENTS IN THE 10 LARGEST SWISS CITIES (Q2 2022 → Q2 2023)

* Median published prices

CLICK HERE TO DOWNLOAD THE FULL REPORT IN PDF FORMAT

Sales and rental price* trends for apartments in the 10 largest Swiss cities (Q2 2022 → Q2 2023)

Switzerland’s Swiss Consumer Price Index inflation rate was 1,7%, between June 2022 and June 2023, Despite being moderate and lower than in most EU countries, it has impacted the daily lives of Swiss residents. In this context of inflation, how have the prices of apartments in the largest cities evolved over the past year?

Apartments rental and sale prices evolution in 2023

In the 10 largest Swiss cities, published rental prices for apartments have increased more than published sale prices for apartments. In most cities, rental price increases have exceeded the official inflation rate. Notably, Switzerland has a higher proportion of renters than the EU average (30.1%), with 57.8% of the Swiss population renting. The Swiss property market has also been affected by rising mortgage rates, which last year saw the biggest increase since the 2008 financial crisis. As a direct result in the 10 largest cities, sales volumes are falling slightly and marketing duration for properties for sale are increasing. According to an analysis conducted using Lookmove data, rental prices are rising significantly in the first half of 2023 compared with the same period in 2022. Overall, the analysis of Lookmove data paints a picture of a real estate market where rental prices are experiencing remarkable growth, and this trend is observed in most of the ten largest cities in Switzerland compared to the first semester of 2022.

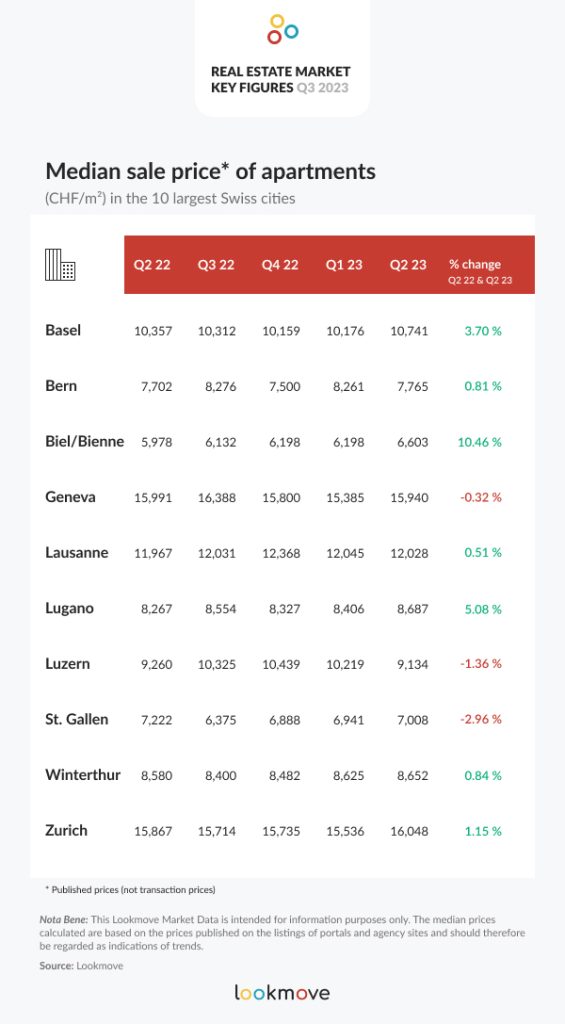

Stabilisation of sale prices in most cities

Stabilisation of sale prices in most cities

Sale prices have remained relatively stable in most cities, with only a few exceptions. Biel/Bienne (+10.46%), Lugano (+5.08%), and Basel (+3.74%) have seen significant price increases, while St.Gallen (-2.96%), Luzern (-1.36%), and Geneva (-0.32%) experienced decreases. Zurich has the highest median price per square meter (CHF 16,048), followed by Geneva (CHF 15,940) and Lausanne (CHF 12,028). Among Switzerland’s major cities, the most affordable cities are Biel/Bienne (CHF 6,603), St. Gallen (CHF 7,008), and Bern (CHF 7,765. It is worth noting that the Swiss National Bank (SNB) reported an increase in the SNB Policy rate in the mentioned period, rising from a negative interest rate of -0.25% in early 2022 to 1.75% since June 2023, a massive increase of 2% with a direct negative impact on mortgage rates.

Rental market trends in 10 most populous Swiss cities

Rental market trends in 10 most populous Swiss cities

Rental published prices for apartments in the largest Swiss cities have risen steadily over the past 12 months. In several cities, including Basel (+3.74%), Biel/Bienne (+3.77%), Geneva (+5.45%), Lausanne (+3.47%), Lugano (+10%), St. Gallen (+3.77%), and Zurich (+3.97%), landlords were able to charge rents well above the official inflation rate. Zurich has the highest monthly prices per square meter (CHF/m2 43.04), while St. Gallen is the most affordable among the top ten largest Swiss cities (CHF/m2 19.99).

Comparing rental prices with inflation rates

Comparing rental prices with inflation rates in most cities, rents have risen faster than the inflation rate. Compared with prices in the second quarter of 2022, landlords were able to charge higher rents in Basel, Biel/Bienne, Geneva, Lausanne, Lugano,St. Gallen and Zurich. Only in Winterthur was the increase lower than the inflation rate. Zurich has the highest prices per square meter in Switzerland, 14.47% higher than Geneva, the second most expensive city. Compared with the cheapest of Switzerland’s ten largest cities, St. Gallen, tenants in Zurich pay more than twice as much per square metre (+ 115.31%).

Positive impact for landlords

Even in cities where sales prices have fallen, rental prices have increased. This suggests that landlords can benefit from higher monthly rents than the previous year, even if property prices drop or remain stable.

Conclusion

In the first semester of 2023, the Swiss real estate market witnessed a notable trend: rental prices increased more than sales prices in the ten largest cities. Rental costs increased faster than the official inflation rate, while sale prices remained relatively stable. This surge in rental prices can be attributed to the impact of rising mortgage interest rates, making it challenging for buyers to secure mortgages. Consequently, landlords benefited from higher rents, even in cities where sales prices were falling. Amid Switzerland’s evolving real estate landscape, the rental market stands out as robust and attractive. At the same time, the marketing duration for properties for sale is tending to become longer (Lookmove data), a sign that the market is readjusting.

Nota Bene

This Lookmove market report is intended for informational purposes only. The data provided reflects published prices and should not be considered transactional or paid prices. Users are encouraged to exercise caution and conduct their own due diligence when using the information provided. Lookmove assumes no responsibility for any decisions made based on the market report’s content. Professional advice should be sought for specific real estate transactions.

*********

Lookmove data and methodology

Data collection and analysis technologies

Lookmove uses cutting-edge proprietary technologies in its vertical search engine to automate the systematic collection and analysis of vast amounts of data from the most prominent real estate platforms, portals and leading agencies, several times a day. This comprehensive crawling and analysis (normalisation, deduplication, curation) methodology ensures the acquisition of up-to-date and reliable data. The report is derived from data obtained through Lookmove’s daily crawling activities, scanning 100 sources in Switzerland and aggregating approximately 750,000 publicly available listings. The data is meticulously processed using proprietary algorithms to remove duplicates, outdated, and incomplete listings, resulting in an average of 135,000 unique active listings (properties) after curation. However, it’s important to emphasise that the prices indicated in the report are published prices and not transactional or paid prices.

Median prices per m²

Median prices indicate that half of the deals were made at a lower price and the other half at a higher price. The advantage of the median as a measure of trend is that it is not influenced by extreme values, unlike average prices. As an illustration, suppose a municipality of 5,000 inhabitants where the price of properties is generally CHF 240,000 to CHF 450,000 and where, during a quarter, two properties which are not representative of the municipality are sold for more than CHF 2,500,000. These 2 transactions raise the average, and at the same time, the price growth in this sector is overestimated. The median price, conversely, is not overly influenced by these non-standard transactions. It therefore offers a better understanding of the market as to prices and their evolution.

General Terms of Use

Prices are given as an indication. Lookmove does not guarantee their perfect accuracy.

*********

- Aargau Immobilien zum Verkauf

- Appenzell Ausserrhoden Immobilien zum Verkauf

- Appenzell Innerrhoden Immobilien zum Verkauf

- Basel-Land Immobilien zum Verkauf

- Basel-Stadt Immobilien zum Verkauf

- Bern Immobilien zum Verkauf

- Freiburg Immobilien zum Verkauf

- Genf Immobilien zum Verkauf

- Glarus Immobilien zum Verkauf

- Graubünden Immobilien zum Verkauf

- Jura Immobilien zum Verkauf

- Luzern Immobilien zum Verkauf

- Neuenburg Immobilien zum Verkauf

- Nidwalden Immobilien zum Verkauf

- Obwalden Immobilien zum Verkauf

- Sankt Gallen Immobilien zum Verkauf

- Schaffhausen Immobilien zum Verkauf

- Schwyz Immobilien zum Verkauf

- Solothurn Immobilien zum Verkauf

- Thurgau Immobilien zum Verkauf

- Tessin Immobilien zum Verkauf

- Uri Immobilien zum Verkauf

- Wallis Immobilien zum Verkauf

- Waadt Immobilien zum Verkauf

- Zug Immobilien zum Verkauf

- Zürich Immobilien zum Verkauf

- Liechtenstein Immobilien zum Verkauf

- Zürich Immobilien zum Verkauf

- Genf Immobilien zum Verkauf

- Basel Immobilien zum Verkauf

- Lausanne Immobilien zum Verkauf

- Bern Immobilien zum Verkauf

- Winterthur Immobilien zum Verkauf

- Luzern Immobilien zum Verkauf

- St. Gallen Immobilien zum Verkauf

- Lugano Immobilien zum Verkauf

- Biel/Bienne Immobilien zum Verkauf

- Thun Immobilien zum Verkauf

- Bellinzona Immobilien zum Verkauf

- Köniz Immobilien zum Verkauf

- Freiburg Immobilien zum Verkauf

- La Chaux-de-Fonds Immobilien zum Verkauf

- Schaffhausen Immobilien zum Verkauf

- Chur Immobilien zum Verkauf

- Vernier Immobilien zum Verkauf

- Uster Immobilien zum Verkauf

- Sitten Immobilien zum Verkauf

- Neuenburg Immobilien zum Verkauf

- Carouge GE Immobilien zum Verkauf

- Emmen Immobilien zum Verkauf

- Zug Immobilien zum Verkauf

- Yverdon-les-Bains Immobilien zum Verkauf

- Dübendorf Immobilien zum Verkauf

- Aargau Immobilien zu vermieten

- Appenzell Ausserrhoden Immobilien zu vermieten

- Appenzell Innerrhoden Immobilien zu vermieten

- Basel-Land Immobilien zu vermieten

- Basel-Stadt Immobilien zu vermieten

- Bern Immobilien zu vermieten

- Freiburg Immobilien zu vermieten

- Genf Immobilien zu vermieten

- Glarus Immobilien zu vermieten

- Graubünden Immobilien zu vermieten

- Jura Immobilien zu vermieten

- Luzern Immobilien zu vermieten

- Neuenburg Immobilien zu vermieten

- Nidwalden Immobilien zu vermieten

- Obwalden Immobilien zu vermieten

- Sankt Gallen Immobilien zu vermieten

- Schaffhausen Immobilien zu vermieten

- Schwyz Immobilien zu vermieten

- Solothurn Immobilien zu vermieten

- Thurgau Immobilien zu vermieten

- Tessin Immobilien zu vermieten

- Uri Immobilien zu vermieten

- Wallis Immobilien zu vermieten

- Waadt Immobilien zu vermieten

- Zug Immobilien zu vermieten

- Zürich Immobilien zu vermieten

- Liechtenstein Immobilien zu vermieten

- Zürich Immobilien zu vermieten

- Genf Immobilien zu vermieten

- Basel Immobilien zu vermieten

- Lausanne Immobilien zu vermieten

- Bern Immobilien zu vermieten

- Winterthur Immobilien zu vermieten

- Luzern Immobilien zu vermieten

- St. Gallen Immobilien zu vermieten

- Lugano Immobilien zu vermieten

- Biel/Bienne Immobilien zu vermieten

- Thun Immobilien zu vermieten

- Bellinzona Immobilien zu vermieten

- Köniz Immobilien zu vermieten

- Freiburg Immobilien zu vermieten

- La Chaux-de-Fonds Immobilien zu vermieten

- Schaffhausen Immobilien zu vermieten

- Chur Immobilien zu vermieten

- Vernier Immobilien zu vermieten

- Uster Immobilien zu vermieten

- Sitten Immobilien zu vermieten

- Neuenburg Immobilien zu vermieten

- Carouge GE Immobilien zu vermieten

- Emmen Immobilien zu vermieten

- Zug Immobilien zu vermieten

- Yverdon-les-Bains Immobilien zu vermieten

- Dübendorf Immobilien zu vermieten