07/12/2023 | Lookmove reports

COMMERCIAL RENTAL PRICES AND AVAILABLE SURFACES (Q3 2022 → Q3 2023)

CLICK HERE TO DOWNLOAD THE FULL REPORT IN PDF FORMAT

Office space for rent in the 10 largest Swiss cities

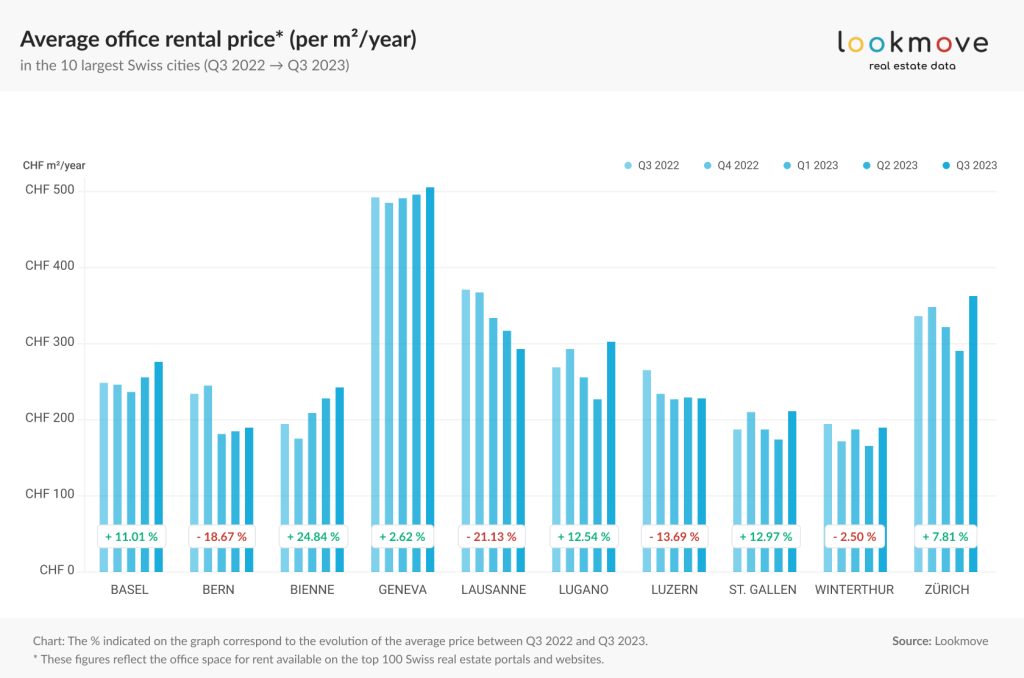

The Covid 19 pandemic, which began in March 2020, has had a severe impact on the commercial real estate market across Europe. Switzerland was no different. Demand for office space fell and, as a result, rental prices per square metre fell. However, once the pandemic was over and employees began to return to their offices after a period of full-time remote working, prices began to rise. Office owners began to demand higher amounts for the use of their properties. In most of the 10 largest Swiss cities analysed for this report, prices per m² increased in the latest period between Q3 2022 and Q3 2023. We also analysed the prices of new office buildings built since 2017, as well as the total surface area and the number of offices available on the market at the end of the third quarter.

Winterthur the cheapest, Geneva the most expensive

Winterthur the cheapest, Geneva the most expensive

Office rental prices in Switzerland’s 10 largest cities show huge differences between Winterthur (average CHF 189.37/m²/year) and Geneva (CHF 505.2/m²/year). The high prices correlate with the number of properties and the total space available on the market. Zurich and Geneva rank first in both categories.

Correlation between average prices and available office space

The largest city in German-speaking Switzerland has the highest number of properties on the market with 145,869 m² in 427 offers and the second highest average price in Q3 2023 (CHF 362.2/m²/year). The largest city in Romandy is second with 119,814 m² of office space available in 404 offers, but first for the average price per m². The cities with the least office space on offer, Biel/Bienne (5,923 m² available in 64 listings) and Lucerne (7,265 m² in 74 listings), are also among the cheapest, with an average price of CHF 242.43 per m² per year in Biel/Bienne and CHF 228.72 per m² per year in Lucerne. The cheapest city is Winterthur, with 13,164 m² and 97 rental properties.

Rises and falls in the average price of an office rent

Rises and falls in the average price of an office rent

Of the 10 largest Swiss cities, an increase was recorded in 6 and a decrease in 4, taking into account price changes within the last year analysed (Q3 2022 to Q3 2023). The highest price increases were recorded in Biel (24.84%), St. Gallen (12.97%) and Basel (11.01%). Large falls were recorded in a city with a relatively large market – Lausanne (21.13%), as well as in Berne (18.67%) and Lucerne (13.69%).

Rental market for new buildings

The most expensive office space in new buildings is currently located in Zurich with an average of CHF 603.7/m²/year, Geneva (CHF 572.3/m²/year) and Lucerne (CHF 406.5/m²/year). The cheapest space in a new building can be rented for just CHF 220/m²/year in St. Gallen, but the number of properties available in this city at the end of Q3 2023 was very low, with only 5 on the market. Notably, there was no new-build office space available in Biel. In general, average rents for new buildings were also higher than for all properties. The largest differences were found in Berne, Lucerne and Zurich. In the city of Lugano, new buildings were only slightly cheaper than the average for all office space.

Conclusion

The commercial property market in Switzerland is very diverse. Large price differences were observed between the largest Swiss cities. The highest average prices, both for all buildings and for new buildings, were recorded in the cities where the market is strongest: Geneva and Zurich. It is much cheaper to rent an office in cities with a small market: Berne, Winterthur, Lucerne or St. Gallen, where average prices are even below CHF 230/m²/year. Some of these cities (Berne, Winterthur, Lucerne) also recorded a fall in prices over the period analysed for this report.

Nota Bene

This Lookmove market report is intended for informational purposes only. The data provided reflects published prices and should not be considered transactional or paid prices. Users are encouraged to exercise caution and conduct their own due diligence when using the information provided. Lookmove assumes no responsibility for any decisions made based on the market report’s content. Professional advice should be sought for specific real estate transactions.

*********

Lookmove data and methodology

Data collection and analysis technologies

Lookmove uses cutting-edge proprietary technologies in its vertical search engine to automate the systematic collection and analysis of vast amounts of data from the most prominent real estate platforms, portals and leading agencies, several times a day. This comprehensive crawling and analysis (normalisation, deduplication, curation) methodology ensures the acquisition of up-to-date and reliable data. The report is derived from data obtained through Lookmove’s daily crawling activities, scanning 100 sources in Switzerland and aggregating approximately 750,000 publicly available listings. The data is meticulously processed using proprietary algorithms to remove duplicates, outdated, and incomplete listings, resulting in an average of 135,000 unique active listings (properties) after curation. However, it’s important to emphasise that the prices indicated in the report are published prices and not transactional or paid prices.

General Terms of Use

Prices are given as an indication. Lookmove does not guarantee their perfect accuracy.

- Aargau Immobilien zum Verkauf

- Appenzell Ausserrhoden Immobilien zum Verkauf

- Appenzell Innerrhoden Immobilien zum Verkauf

- Basel-Land Immobilien zum Verkauf

- Basel-Stadt Immobilien zum Verkauf

- Bern Immobilien zum Verkauf

- Freiburg Immobilien zum Verkauf

- Genf Immobilien zum Verkauf

- Glarus Immobilien zum Verkauf

- Graubünden Immobilien zum Verkauf

- Jura Immobilien zum Verkauf

- Luzern Immobilien zum Verkauf

- Neuenburg Immobilien zum Verkauf

- Nidwalden Immobilien zum Verkauf

- Obwalden Immobilien zum Verkauf

- Sankt Gallen Immobilien zum Verkauf

- Schaffhausen Immobilien zum Verkauf

- Schwyz Immobilien zum Verkauf

- Solothurn Immobilien zum Verkauf

- Thurgau Immobilien zum Verkauf

- Tessin Immobilien zum Verkauf

- Uri Immobilien zum Verkauf

- Wallis Immobilien zum Verkauf

- Waadt Immobilien zum Verkauf

- Zug Immobilien zum Verkauf

- Zürich Immobilien zum Verkauf

- Liechtenstein Immobilien zum Verkauf

- Zürich Immobilien zum Verkauf

- Genf Immobilien zum Verkauf

- Basel Immobilien zum Verkauf

- Lausanne Immobilien zum Verkauf

- Bern Immobilien zum Verkauf

- Winterthur Immobilien zum Verkauf

- Luzern Immobilien zum Verkauf

- St. Gallen Immobilien zum Verkauf

- Lugano Immobilien zum Verkauf

- Biel/Bienne Immobilien zum Verkauf

- Thun Immobilien zum Verkauf

- Bellinzona Immobilien zum Verkauf

- Köniz Immobilien zum Verkauf

- Freiburg Immobilien zum Verkauf

- La Chaux-de-Fonds Immobilien zum Verkauf

- Schaffhausen Immobilien zum Verkauf

- Chur Immobilien zum Verkauf

- Vernier Immobilien zum Verkauf

- Uster Immobilien zum Verkauf

- Sitten Immobilien zum Verkauf

- Neuenburg Immobilien zum Verkauf

- Carouge GE Immobilien zum Verkauf

- Emmen Immobilien zum Verkauf

- Zug Immobilien zum Verkauf

- Yverdon-les-Bains Immobilien zum Verkauf

- Dübendorf Immobilien zum Verkauf

- Aargau Immobilien zu vermieten

- Appenzell Ausserrhoden Immobilien zu vermieten

- Appenzell Innerrhoden Immobilien zu vermieten

- Basel-Land Immobilien zu vermieten

- Basel-Stadt Immobilien zu vermieten

- Bern Immobilien zu vermieten

- Freiburg Immobilien zu vermieten

- Genf Immobilien zu vermieten

- Glarus Immobilien zu vermieten

- Graubünden Immobilien zu vermieten

- Jura Immobilien zu vermieten

- Luzern Immobilien zu vermieten

- Neuenburg Immobilien zu vermieten

- Nidwalden Immobilien zu vermieten

- Obwalden Immobilien zu vermieten

- Sankt Gallen Immobilien zu vermieten

- Schaffhausen Immobilien zu vermieten

- Schwyz Immobilien zu vermieten

- Solothurn Immobilien zu vermieten

- Thurgau Immobilien zu vermieten

- Tessin Immobilien zu vermieten

- Uri Immobilien zu vermieten

- Wallis Immobilien zu vermieten

- Waadt Immobilien zu vermieten

- Zug Immobilien zu vermieten

- Zürich Immobilien zu vermieten

- Liechtenstein Immobilien zu vermieten

- Zürich Immobilien zu vermieten

- Genf Immobilien zu vermieten

- Basel Immobilien zu vermieten

- Lausanne Immobilien zu vermieten

- Bern Immobilien zu vermieten

- Winterthur Immobilien zu vermieten

- Luzern Immobilien zu vermieten

- St. Gallen Immobilien zu vermieten

- Lugano Immobilien zu vermieten

- Biel/Bienne Immobilien zu vermieten

- Thun Immobilien zu vermieten

- Bellinzona Immobilien zu vermieten

- Köniz Immobilien zu vermieten

- Freiburg Immobilien zu vermieten

- La Chaux-de-Fonds Immobilien zu vermieten

- Schaffhausen Immobilien zu vermieten

- Chur Immobilien zu vermieten

- Vernier Immobilien zu vermieten

- Uster Immobilien zu vermieten

- Sitten Immobilien zu vermieten

- Neuenburg Immobilien zu vermieten

- Carouge GE Immobilien zu vermieten

- Emmen Immobilien zu vermieten

- Zug Immobilien zu vermieten

- Yverdon-les-Bains Immobilien zu vermieten

- Dübendorf Immobilien zu vermieten